What is an umbrella policy?

If a major accident exhausted the coverage you already paid for, you might find yourself in a tough spot. Umbrella insurance gives you that extra layer of coverage when you are responsible for damages that exceed the liability limits on your auto or homeowner policy.

The more you have the more you have to protect…

Life happens and in a blink of an eye a multi-million dollar lawsuit can put your assets at risk including your home, car, property, and savings. Here are some examples of situations that could occur leaving you exposed to a huge financial loss:

- Visitor slips and falls at your home.

- Your dog bites your child’s friend.

- A family member’s social media post results in a defamation suit.

What is covered?

In general, umbrella policy covers a wide range of events for which an insurance customer or household member becomes legally liable to pay as result of:

- Bodily Injury - Medical costs and loss of income.

- Property Damage – Damage, destruction or loss of use of tangible property.

- Automobile liability coverage is limited to bodily injury and property damage arising out of occurrences within the US, Canada or Puerto Rico.

- Personal Injury – Offenses which take place anywhere in the world.

MYTH: Federal disaster assistance will pay for flood damage.

FACT: Before a community is eligible for disaster assistance, it must be declared a federal disaster area. Federal disaster assistance declarations are issued in less that 50% of flooding events. The premium for an NFIP policy of a property in a preferred area is averaging less that 500 a year. and can be a lot less expensive than the monthly payments on a federal disaster loan. Yes, federal disaster assistance is not FREE.

Furthermore, if you are uninsured and receive disaster assistance after a flood, you must purchase flood insurance to remain eligible for future disaster relief.

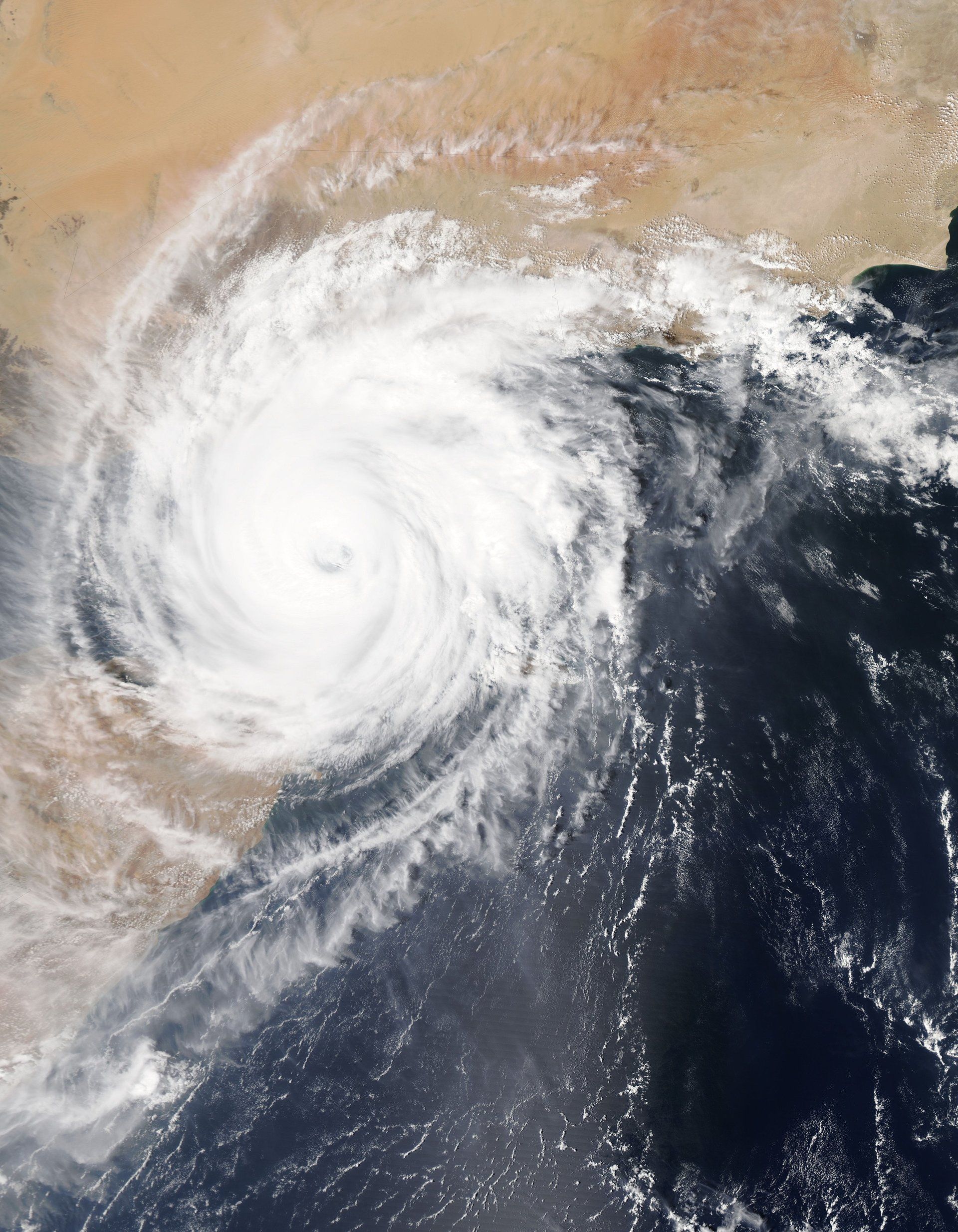

MYTH: The NFIP does not cover flooding resulting from hurricanes or the overflow of rivers or tidal waters.

FACT: The NFIP defines covered flooding as a general and temporary condition which the surface of a normally dry land is partially or completely inundated. Two properties in the area or two or more acres must be affected. Flooding can be cause by:

- overflow of inland or tidal waters, or

- unusual or rapid accumulation or runoff of surface waters from any source, such as heavy rainfall, or

- mudflow, i.e. a river of liquid and flowing mud on the surfaces of normally dry land areas, or

- collapse or subsidence of land along the shore of a lake or other body of water, resulting from erosion or the effect of waves, or water currents exceeding normal, cyclical levels.

I conclude our Blog Series. Thank you all for stopping by. Be safe, be well.

Myth: The NFIP does not offer any type of basement coverage.

Fact: Yes it does. The NFIP defines a basement as any area of a building with a floor that is below ground level on all sides. While flood insurance does not cover basement improvements (such as finished walls, floors, or ceilings) or personal belongings kept in a basement (such as furniture and other contents), it does cover structural elements and essential equipment.

The following items are covered under building coverage, as long as they are connected to a power source, if required and installed in their functioning location:

- Sump pumps

- Well water tanks and pumps, cisterns, and the water in them

- Oil tanks and the oil in them, natural gas tanks and the gas in them

- Pumps and/or tanks used in conjunction with solar energy

- Furnaces, water heaters, air conditioners, and heat pumps

- Electrical junction and circuit breaker boxes and required utility connections

- Foundation elements

- Stairways, staircase, elevators, and dumbwaiters

- Unpainted drywall walls and ceilings, including nonflammable insulation

The following are covered under contents coverage:

- Clothes washers and dryers

- Food freezers and the food in them

The NFIP recommends both building and contents coverage for the broadest protecttion.

Myth: The NFIP encourages coastal development.

Fact : One of the NFIP's primary objectives is to guide development away from high flood risk areas. NFIP regulations minimize the impact of structures that are built in SFHA's by requiring them not to cause obstructions to the natural flow of floodwaters. Also as a condition of community participation in the NFIP, those structures built within SFHA's must adhere to strict floodplain management regulations enforced by the community.

In addition, the Coastal Barrier Resources Act (CBRA) of 1982 relies on the NFIP to discourage building in fragile coastal areas by prohibiting the sale of flood insurance in designated CBRA areas. While the NFIP does not prohibit property owners from building in their areas, any Federal financial assistance, including federally backed flood insurance, is prohibited. However, the CBRA does not prohibit privately financed development or insurance.

You should have some questions by now. Call us at 941-210-4499, we are happy to help.

Myth: Only residents of high-flood risk areas need to insure their property.

Fact: All areas are susceptible to flooding, although to varying degrees. If you live in a low-to-moderate flood risk area, it is advisable to have flood insurance. Nearly 20% of the NFIP's claims come from outside high-flood risk areas. This percentage may have risen during the last 2 years. Residential and commercial property owners located in low-to-moderate risk areas should ask their agents if they are eligible for the Preferred Risk Policy, which provides inexpensive insurance protection.

Myth: National Flood Insurance can only be purchased through the NFIP directly .

Fact: NFIP flood insurance is sold thru private insurance companies and agents, and it is backed by the federal government.

It is very true that most people might perceive flood insurance as expensive. If your property is located in a preferred area, it could be as low as $460.00 per year. Until the next time, be safe. Evella

MYTH: Flood Insurance is only for homeowners.

Fact: Most people who live in NFIP participating communities, including renters and condo unit owners, are eligible to purchase a federally back flood insurance. A maximum of $250,000.00 of building coverage is available for single family residential buildings; $250,000.00 per unit for residential condominiums. The limit for contents coverage on all residential buildings is $100,000.00, which is also available to renters.

Commercial structures can be insured to a limit of $500,000.00 for the building and $500,000.00 for the contents. The maximum insurance limit may not exceed the insurable value of the property.

Myth: You cannot buy flood insurance if your property has been flooded.

Fact: You are still eligible to purchase flood insurance after your home, apartment, or business has been flooded, provided that your community is participating in the NFIP. Any flooding and claims that occurred before the inception of the new policy is not a covered loss.

We have seen how erratic the weather can be and how fast flooding occurs in ANY AREA. Do not be caught in thinking that because your property in not in a flood zone, that your property is not at risk.

Until the next time, ask me questions. We are here for you. Evella

DAY ONE:

WHO NEEDS FLOOD INSURANCE? EVERYONE!

And almost everyone in a participating community of the National Flood Insurance Program (NFIP) can buy flood insurance. Nationwide, more than 20,000 communities have joined the program. In some instances, people have been told that they cannot buy flood insurance because of where they live. To clear this up and other misconceptions about National Flood Insurance, the NFIP has compiled a list of common myths about the program, and the real facts behind them, to give you the full story about this valuable protection.

MYTH: YOU CANNOT BUY FLOOD INSURANCE IF YOU ARE LOCATED IN A HIGH-FLOOD RISK AREA.

FACT: You can buy flood insurance no matter where you live if your community participates in the NFIP, except in Coastal Barrier Resources Systems (CBRS) or other protected areas. The program was created in 1968 to make federally backed flood insurance available to property owners who live in eligible communities. Flood insurance was then virtually unavailable from the private insurance industry. The flood disaster act of 1973, as amended, requires federally regulated lending institutions to make sure that mortgage loans secured by buildings in high flood risk areas are protected by flood insurance. Lenders should notify borrowers prior to closing that their property is located in a high-flood risk area and that National Flood Insurance is required.

As a current update: There are now several private insurance carriers who offers flood insurance to consumers. If you have questions or comments, please respond below in a professional and respectful way and I will address them. Until tomorrow for the next Myth and Fact. Make today a good day.

We are here for you,

Evella

1) Start with the right homeowners insurance and flood insurance protection: Visit www.autolifegroup.com

2) Know your communities severe weather warning system and follow new reports closely.

3) Identify escape routes from your home and neighborhood.

4) Research the evacuation plans for your workplace and children's schools.

5) Designate an emergency meeting place for your family.

6) Plan and decide where you and your pets can take shelter when necessary.

7) Establish a contact point to communicate with concerned relatives and friends. There is an app for that.

8) Take a video and pictures of your home inside and outside. Meticulously record upgrades and valuables.

9) Have drinking water and emergency kit prepared and ready to go.

10) Fill your bathtub with water that can be used for flushing toilets and or for washing.

We are here for you.

For better or worse, anyone can write a blog post about anything they want. Everyone has a voice and the best voices will rise to the top.

The writer can show their personality:

In blog posts, the writer has more leeway to add in their voice and personality than other types of writing.

Blogs are a great form of mass communication:

You can help people, learn new things, entertain your audience—the possibilities are endless and amazing. Blogging opens up all of these to a very wide audience.

You can make money:

Get the right blog going and you can make a lot of money through advertising and sponsored posts.

It allows people to craft better thoughts:

Instead of reading haphazard, uneducated Facebook statuses, it’s much better to see people’s thought process in a well-written blog post.

You can establish a community:

Blogging allows you to connect with other individuals who share the same interests. Sharing ideas and opinions within your community helps establish yourself as a thought leader.

Good for SEO:

Keeping content on your site fresh and relevant, you can use your blog to boost the search engine ranking (SEO) of your site and your business.

It brings people back to your site:

If your blog is strong enough and updated regularly, people will come back looking for more and bring traffic back to your site as well.

It’s free:

It costs you a grand total of zero dollars to post to the blog, so if you have something to say, there’s nothing to stop you.

You can establish yourself as a thought leader:

A blog is a great place for your original thoughts, and it can be a wonderful way to show off your individuality. If people like your ideas, you can become a thought leader in your industry!

What else do you love about blogs? Let me know!